Here are some updates on the Permian Basin and oil:

"End of Oil Collapse in Sight for BofA, BNP Paribas" (click here for article).

"WTI Rebound Above $80 Holds as Goldman Sees No Oil Glut" (click here).

"Oil Collapse Gives Buyers Chance at Top Target: Real M&A" (click here).

Friday, October 17, 2014

Wednesday, October 15, 2014

Buying opportunity?

Along with

oil prices, Lynden Energy Corp. has taken a big hit the last few weeks. The stock price is down over 40% from its

high reached on September 2. This has

created a tremendous buying opportunity.

Lynden has acreage located in the heart of the Permian Basin. Is this a high risk/high reward

investment? Those who have read the analysis

on Seeking Alpha in August and agree with the summary can argue that there is

little risk in this investment.

Lynden Energy

has zero net debt and a market cap of $80 milllion (US). With 5,883 net acres in the Wolfberry, Lynden’s

per acre valuation is $13,500/net acre (US).

Wolfberry land deals over the past year have averaged $43,870/net acre

(US).

One can look

at the valuation metrics a number of ways but the conclusion remains the same,

Lynden Energy is undervalued! Those who

have the patience and confidence that LVL will eventually find a suitor to

acquire their Wolfberry acreage could realize the significant upside.

Recent Significant Events Relevant to Lynden Energy

Several recent events relevant to Lynden Energy Corp. have occurred over the past year including nearby land sales and bullish analyses. We have listed them below.

October 2014 - Cormark Securities increases LVL target price to $2.00

August 2014 - Excellent Seeking Alpha analysis of LVL released

June 2014 - Energy Report mentions Lynden Energy

March 2014 - Torrey Hills Capital issues bullish analysis

March 2014 - Keith Schaefer of Oil and Gas Investment Bulletin issues update

November 2013 - Cormark initiates coverage

October 2013 - Thom Calandra releases bullish analysis

October 2013 - Torrey Hills Capital release article

Recent Deals

9/13, FANG, Midland County, $440.0 M, 12,500 net acres, $35,200/net acre

12/13, QEP, Martin and Andrews Counties, $950.0 M, 26,500 net acres, 6,700 boe/d, $35,849/net acre, $141,791/flowing barrel

Averages, $43,870/net acre and $167,144/flowing barrel.

LVL has 5,883 net acres in Glasscock, Howard, Martin and Midland Counties.

5,883 net acres at $43,870/acre = $258 million (US$)

143.4 million shares fully diluted = $1.80/share (US$)

October 2014 - Cormark Securities increases LVL target price to $2.00

August 2014 - Excellent Seeking Alpha analysis of LVL released

June 2014 - Energy Report mentions Lynden Energy

March 2014 - Torrey Hills Capital issues bullish analysis

March 2014 - Keith Schaefer of Oil and Gas Investment Bulletin issues update

November 2013 - Cormark initiates coverage

October 2013 - Thom Calandra releases bullish analysis

October 2013 - Torrey Hills Capital release article

Recent Deals

9/13, FANG, Midland County, $440.0 M, 12,500 net acres, $35,200/net acre

12/13, QEP, Martin and Andrews Counties, $950.0 M, 26,500 net acres, 6,700 boe/d, $35,849/net acre, $141,791/flowing barrel

12/13, Breitburn, Martin County, $19.3 M, 403 net acres, $47,891/net

acre

1/14, ATHL, Northern Midland Basin, $85.0M, 5,645 net acres, 750 boe/d,

$15,058/net acre, $113,333/flowing barrel

2/14, FANG, Martin County, $174.0 M, 2,825 net acres, 1,600 boe/d, $61,593/net

acre, $108,750/flowing barrel

4/14, Crude Energy, Sterling County, 1,840 net acres

4/14, ATHL, Martin, Upton, Andrews and Glasscock Counties, $873.0 M, 23,500

net acres, 4,800 boe/d, $37,149/net acre, $181,875/flowing barrel

7/14, FANG, Midland and Glasscock Counties, $538.0 M, 13,136 net acres,

2,173 boe/d, $40,956/net acre, $247,584/flowing barrel

7/14, RSPP, Glasscock County, $259.0 M, 6,652 net acres, 1,106 boe/d, $38,936/net

acre, $234,177/boe/d

8/14, ATHL, Martin, Midland and Glasscock Counties, $382.0 M, 6,450 net

acres, 3,000 boe/d, $59,225/net acre, $127,333/flowing barrel

8/14, PE, Reagan County, $252.0 M, 5,472 net acres, 1,800 boe/d, $46,053/net

acre, $140,000/flowing barrel

9/14, CPE, Midland, Andrews, Martin and Ector Counties, $205.0 M, 3,862

net acres, 1,465 boe/d, $53,081/net acre, $139,932/flowing barrel

9/14, ECA, Martin, Howard, Midland and Glasscock Counties, $7,100.0 M, 140,000

net acres, 30,000 boe/d, $50,714/net acre, $236,667/flowing barrel

10/14, KKR, Midland and Ector Counties, $350.0 M, 7,200 net acres, $48,611/net

acre

Averages, $43,870/net acre and $167,144/flowing barrel.

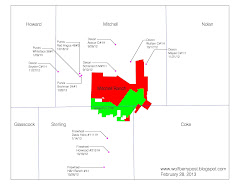

LVL has 5,883 net acres in Glasscock, Howard, Martin and Midland Counties.

5,883 net acres at $43,870/acre = $258 million (US$)

143.4 million shares fully diluted = $1.80/share (US$)

Thursday, October 2, 2014

Cormark Securities increases LVL target price to $2.00

Cormark Securities reiterated their Buy rating for Lynden Energy Corp. and increased their target price to $2.00 from $1.75 on Wednesday. They also expect continued consolidation and believe that Lynden could be a candidate for acquisition.

Monday, September 29, 2014

Encana Buys Athlon Energy for $7.1 Billion

EnCana entered into an agreement to buy Athlon Energy for $7.1 billion (click here).

Valuation metrics for the deal:

$5.93 billion and assumption of $1.15 billion debt

100% Permian primarily in Martin, Howard, Midland and Glasscock Counties

140,000 net acres = $50,700/acre

28 mboe/d = $250k/flowing barrel

Lynden Energy has 5,883 net acres in the same counties!

5,883 net acres x $50,700/net acre = $300 million

w/ 143.4 million fully diluted shares and discounting 20% as Lynden is not an operator, this translates to a per share price of $1.67/share US$ not including any value for Lynden's 52,000 net acres at Mitchell Ranch.

Valuation metrics for the deal:

$5.93 billion and assumption of $1.15 billion debt

100% Permian primarily in Martin, Howard, Midland and Glasscock Counties

140,000 net acres = $50,700/acre

28 mboe/d = $250k/flowing barrel

Lynden Energy has 5,883 net acres in the same counties!

5,883 net acres x $50,700/net acre = $300 million

w/ 143.4 million fully diluted shares and discounting 20% as Lynden is not an operator, this translates to a per share price of $1.67/share US$ not including any value for Lynden's 52,000 net acres at Mitchell Ranch.

Monday, September 15, 2014

New Lynden Corporate Presentation added to website

A new Corporate Presentation was added to Lynden Energy's website with a lot of new information(click here).

Monday, August 25, 2014

Parsley Energy announces deal for 5,472 net acres for $252 million

Parsley Energy just announced a

deal for 5,472 net acres in Reagan County for $252 million. The deal

includes 1,800 boe/d. Metrics work out to: $46k/net acre and $140k per

flowing barrel (click here).

Subscribe to:

Posts (Atom)